The Q3-2023 Real Estate Numbers Are In - Single Family Edition

How did your town or neighborhood fare?

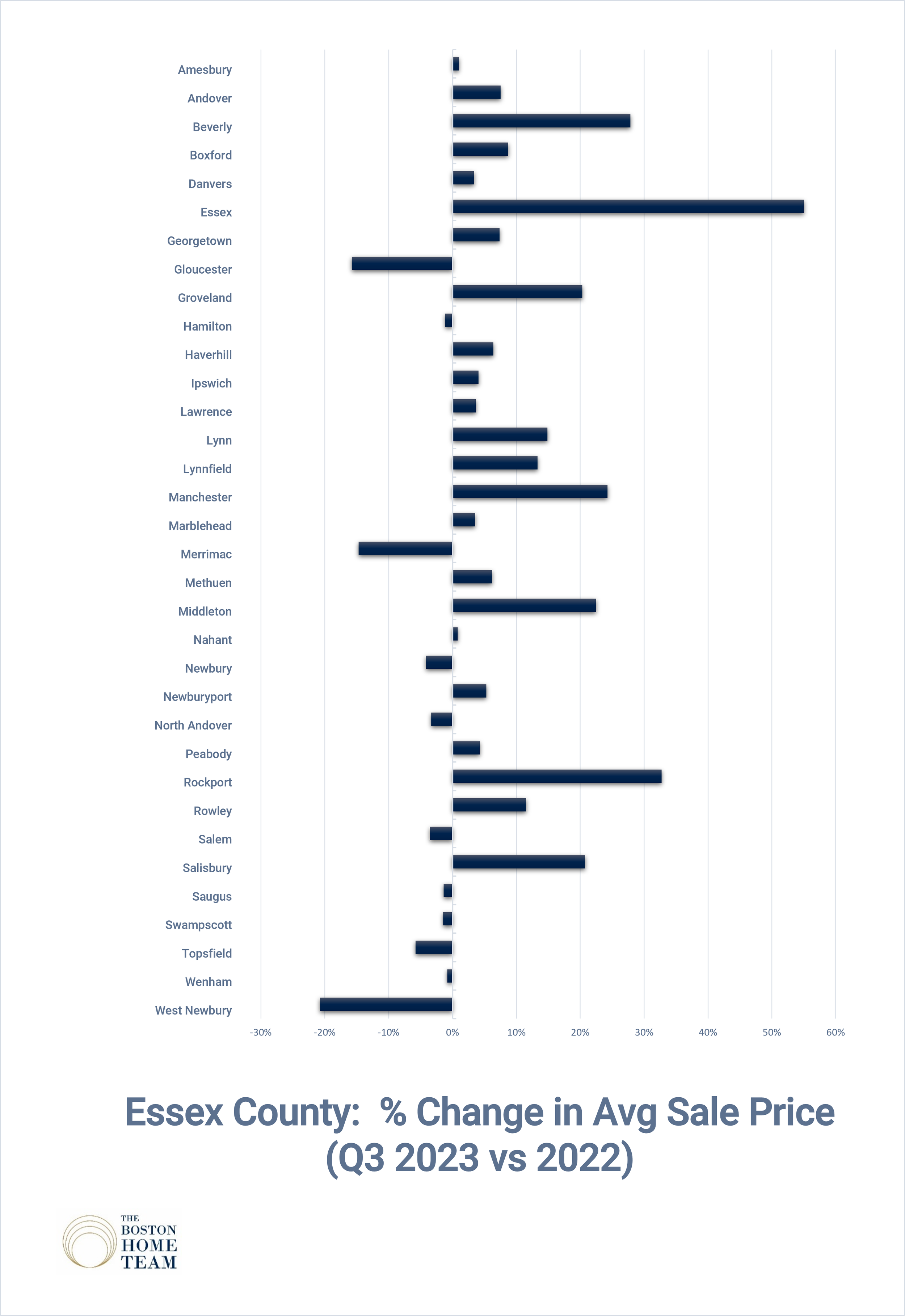

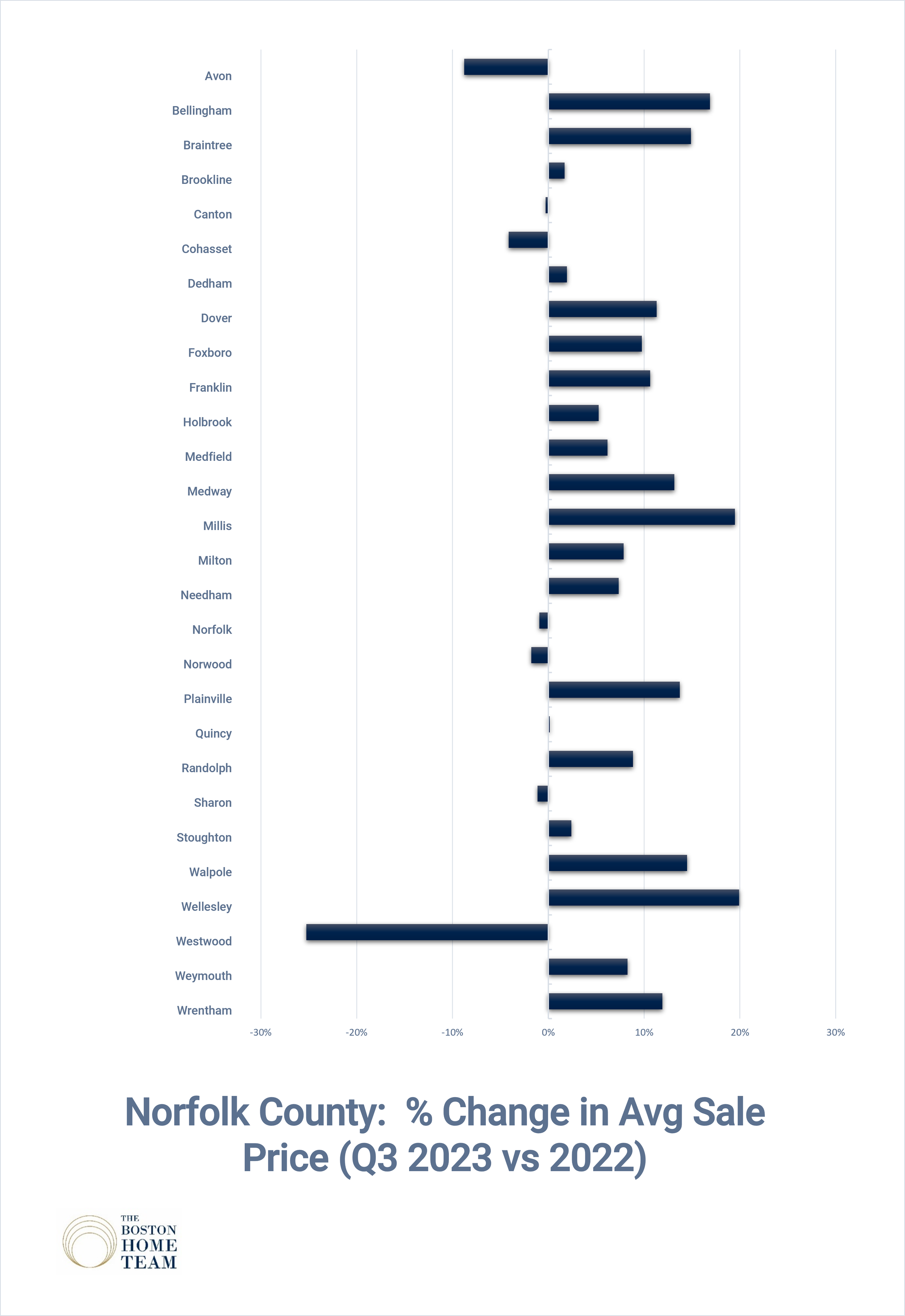

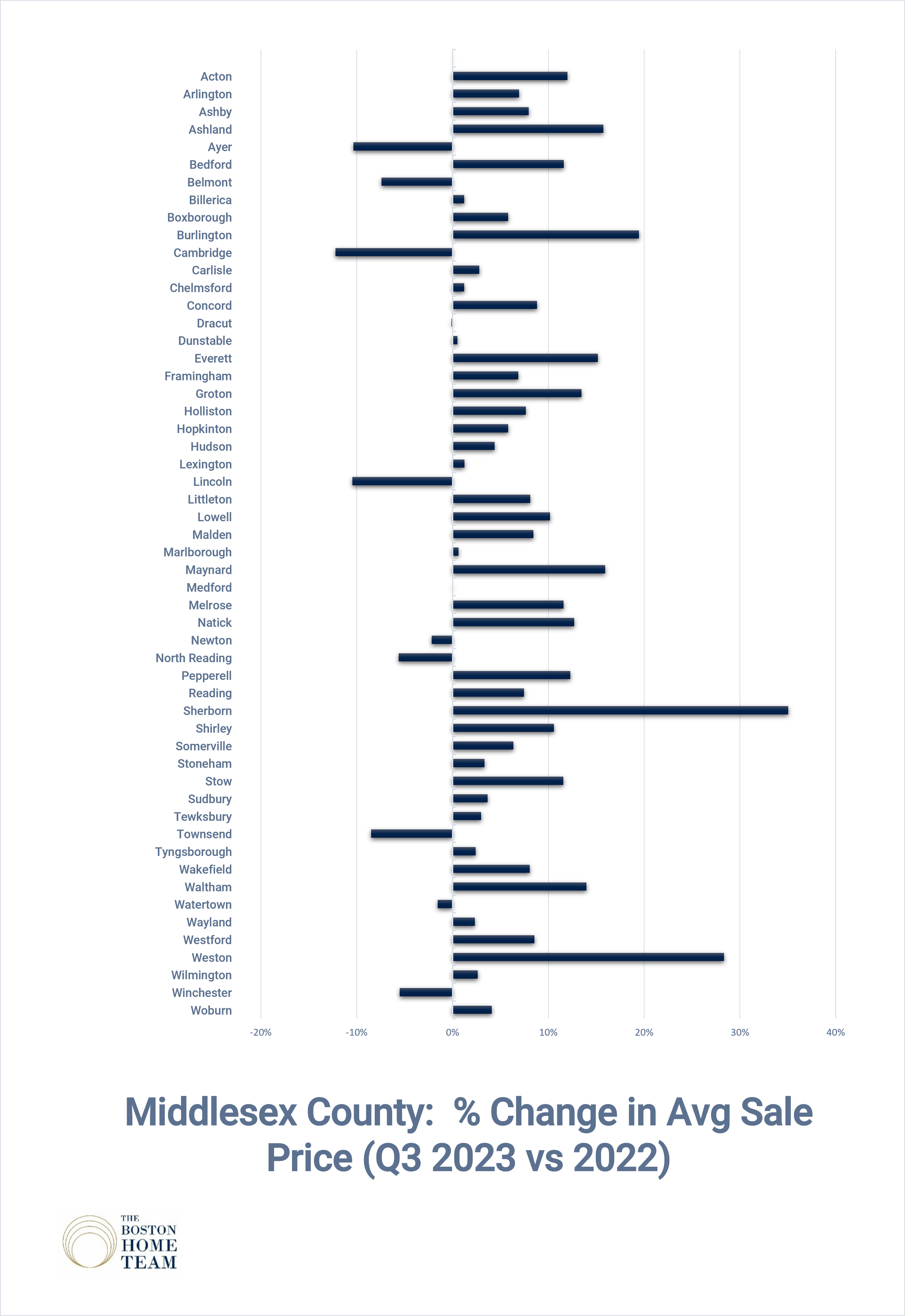

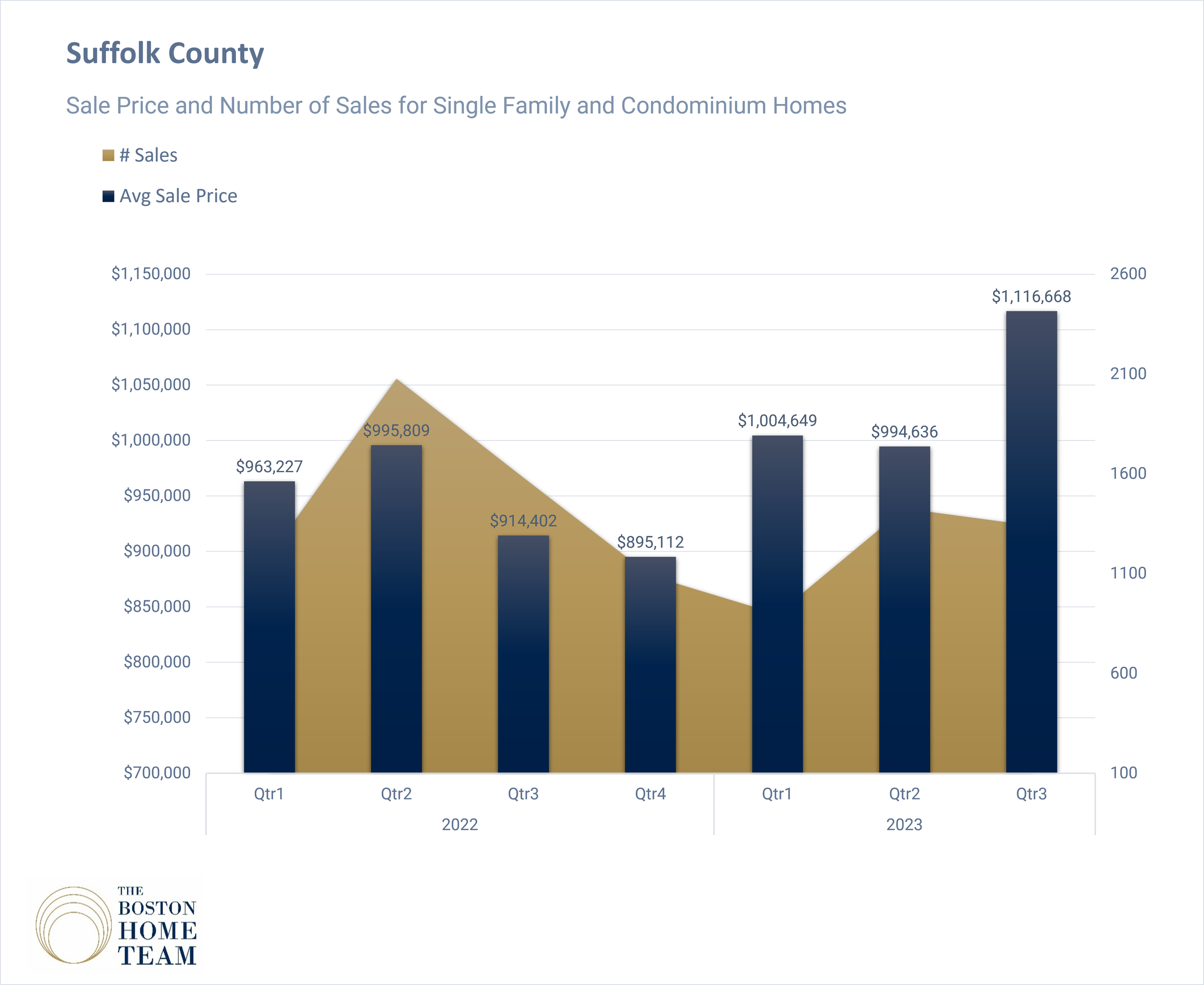

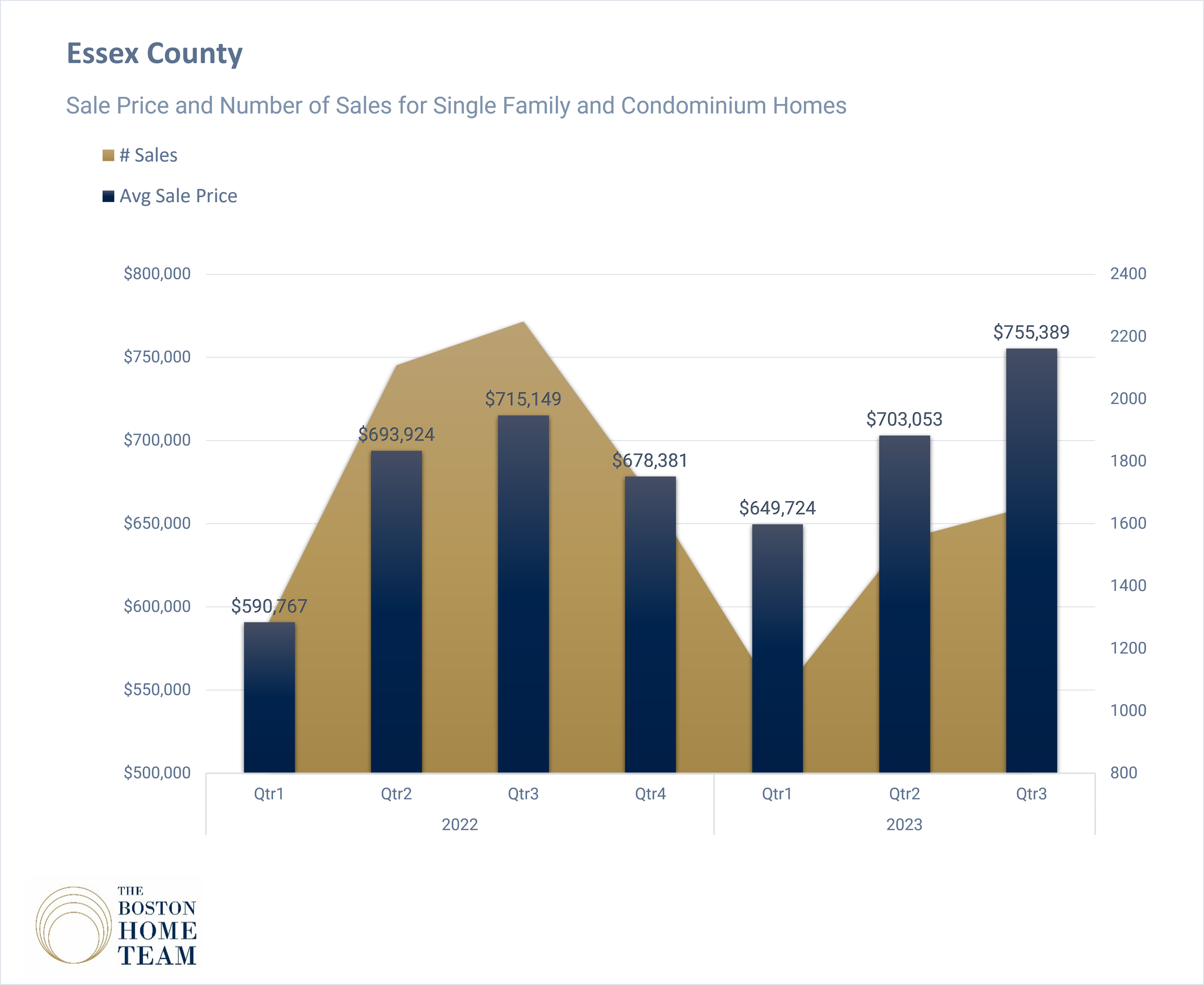

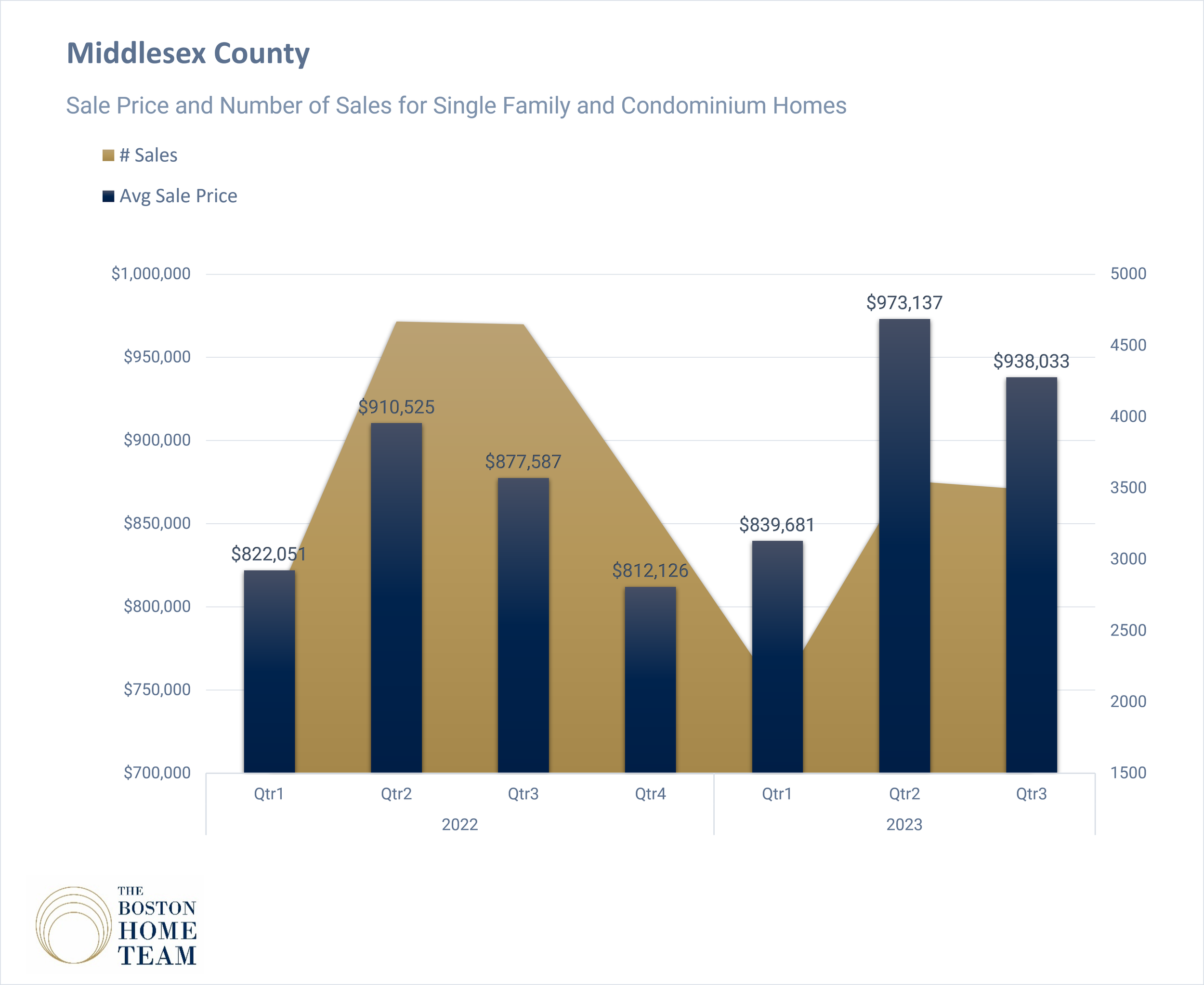

We pulled the sales numbers from MLS and compared this most recent (Q3-2023) to the previous quarter and the same quarter last year. Since we cover a broad variety of different markets over 4-5 counties, we selected the single family sales data from a handful of towns and Boston neighborhoods.

Other than the shrinking inventory which, with few exceptions, is the case for for most of the markets, there aren’t many other overarching trends we can report on. Some areas are seeing prices drop while market time rises. Others are experiencing record price jumps. It’s why we always say to take national or regional Real Estate market reporting with a big shiny grain of sea salt, because Real Estate is local. When we’re working with clients in a specific area we never assume that any market data is iterative.

Below you’ll find a breakdown, town by town, of this past quarter’s performance. Speckled in you’ll also find some of Boston’s neighborhoods since they are much like their own towns and often vary in their market performance.

But first, some highlights from this report. This is for condos only. If you’d like to view the condominium market report, click here. And yes, I asked AI to read our data table to give us the highlights.

Biggest Changes:

Acton had the largest increase in the number of single-family homes sold, with a 42.2% increase from the previous quarter.

Belmont saw a significant decrease in the number of homes sold, down by 23.3% from the last quarter.

Beverly had a remarkable increase in average sale price, up by 27.09% from last year.

Holbrook experienced a significant decrease in the number of homes sold, down by 51.2% from the previous quarter.

Swampscott had a substantial decrease in average sale price, down by 18.6% from the last quarter.

Boxford had a substantial decrease in the number of homes sold, down by 17.9% from the previous quarter.

Braintree had notable increases in both average sale price and average price per square foot, up by 24.85% and 22.63% respectively from the last year.

Dorchester saw a significant decrease in the number of homes sold, down by 56.52% from last year.

Framingham had the largest increase in the number of single-family homes sold, with a 43.5% increase from the previous quarter.

Needham had a substantial decrease in the number of homes sold, down by 14.63% from the last year.

Areas that Improved the Most:

Beverly had the most improvement in average sale price, up by 27.09% from last year.

Framingham had the largest increase in the number of single-family homes sold, with a 43.5% increase from the previous quarter.

Boxford saw an improvement in average sale price, up by 8.7% from last year.

Braintree had significant improvements in both average sale price and average price per square foot, up by 24.85% and 22.63% respectively from last year.

Malden saw an improvement in the number of homes sold, up by 42.4% from the previous quarter.

Most Promising Trends:

Significant increases in the average sale price in towns like Beverly and Braintree.

A substantial increase in the number of homes sold in Acton and Framingham.

Stable sale-to-list ratios in many towns, indicating strong demand.

Least Promising Trends:

Decreases in average sale price in towns like Swampscott and Belmont.

Significant decreases in the number of homes sold in towns like Holbrook and Dorchester.

Longer average days to offer in some areas, such as Chelsea and Nahant.

Overarching Trends:

Overall, the housing market seems to be facing challenges, with many areas experiencing decreases in the number of homes sold compared to last year. However, some towns are showing resilience with substantial increases in average sale prices, indicating strong demand. Sale-to-list ratios are pretty stable, which suggests that buyers are still willing to pay competitive prices in most areas.

Q3 - 2023 (Multiple Items) County Single Family Market Summary - (Alphabetical)

If you don’t see your town or neighborhood on this list, give us a shout and we’ll send you a full report for this quarter and be sure to include in next quarter’s report.

Acton: 64 single families sold - up from 45 (42.2%) last qtr and down -13.51% from last year.

Avg Sale Price: $971.3K (down -0.52% from last quarter, and up 4.65% from last year).

Avg $$$/SQFT: $358 (down -3.5% from last quarter, and up 1.13% from last year).

Sale to List Ratio: 106.39% (107.57% last quarter & 107.23% in Q3 - 2022)

11 avg days to offer (from 11 days last quarter & 11 days in Q3 - 2022)

Andover: 84 single families sold - up from 59 (42.4%) last qtr and down -20% from last year.

Avg Sale Price: $1.13M (up 5.51% from last quarter, and up 9.78% from last year).

Avg $$$/SQFT: $357 (down -0.01% from last quarter, and up 1.38% from last year).

Sale to List Ratio: 105.66% (106.91% last quarter & 104.33% in Q3 - 2022)

12 avg days to offer (from 10 days last quarter & 12 days in Q3 - 2022)

Arlington: 65 single families sold - up from 59 (10.2%) last qtr and down -14.47% from last year.

Avg Sale Price: $1.28M (up 3.51% from last quarter, and up 3.85% from last year).

Avg $$$/SQFT: $564 (down -5.2% from last quarter, and up 3.74% from last year).

Sale to List Ratio: 105.65% (108.92% last quarter & 107.23% in Q3 - 2022)

14 avg days to offer (from 12 days last quarter & 11 days in Q3 - 2022)

Belmont: 33 single families sold - down from 43 (-23.3%) last qtr and down -23.26% from last year.

Avg Sale Price: $1.59M (down -4.13% from last quarter, and down -12.29% from last year).

Avg $$$/SQFT: $643 (down -7.58% from last quarter, and up 3.02% from last year).

Sale to List Ratio: 101.61% (106.18% last quarter & 102.87% in Q3 - 2022)

47 avg days to offer (from 19 days last quarter & 23 days in Q3 - 2022)

Beverly: 68 single families sold - up from 45 (51.1%) last qtr and down -2.86% from last year.

Avg Sale Price: $892.3K (up 6.84% from last quarter, and up 27.09% from last year).

Avg $$$/SQFT: $433 (down -3.97% from last quarter, and up 11.46% from last year).

Sale to List Ratio: 106.09% (104.96% last quarter & 105.19% in Q3 - 2022)

12 avg days to offer (from 14 days last quarter & 12 days in Q3 - 2022)

Boxford: 23 single families sold - down from 28 (-17.9%) last qtr and down -28.13% from last year.

Avg Sale Price: $1.02M (down -6.28% from last quarter, and up 8.7% from last year).

Avg $$$/SQFT: $323 (down -4.33% from last quarter, and down -0.85% from last year).

Sale to List Ratio: 101.66% (103.83% last quarter & 103.01% in Q3 - 2022)

19 avg days to offer (from 27 days last quarter & 17 days in Q3 - 2022)

Braintree: 55 single families sold - up from 43 (27.9%) last qtr and down -28.57% from last year.

Avg Sale Price: $885.4K (up 24.85% from last quarter, and up 21.87% from last year).

Avg $$$/SQFT: $462 (up 22.63% from last quarter, and up 22.23% from last year).

Sale to List Ratio: 122.15% (103.69% last quarter & 101.69% in Q3 - 2022)

9 avg days to offer (from 13 days last quarter & 16 days in Q3 - 2022)

Brookline: 41 single families sold - 0 41 (0%) last qtr and up 32.26% from last year.

Avg Sale Price: $2.36M (down -17.72% from last quarter, and down -15.15% from last year).

Avg $$$/SQFT: $710 (down -2.68% from last quarter, and down -2.48% from last year).

Sale to List Ratio: 100.25% (104.59% last quarter & 100.76% in Q3 - 2022)

18 avg days to offer (from 14 days last quarter & 21 days in Q3 - 2022)

Cambridge: 21 single families sold - down from 29 (-27.6%) last qtr and down -36.36% from last year.

Avg Sale Price: $2.38M (down -15.73% from last quarter, and down -12.66% from last year).

Avg $$$/SQFT: $940 (down -3.36% from last quarter, and down -2.65% from last year).

Sale to List Ratio: 103.5% (103.7% last quarter & 105.92% in Q3 - 2022)

17 avg days to offer (from 35 days last quarter & 18 days in Q3 - 2022)

Canton: 40 single families sold - up from 35 (14.3%) last qtr and down -28.57% from last year.

Avg Sale Price: $950.2K (up 13.07% from last quarter, and down -9% from last year).

Avg $$$/SQFT: $363 (down -1.18% from last quarter, and down -1.95% from last year).

Sale to List Ratio: 102.92% (102.6% last quarter & 104.33% in Q3 - 2022)

21 avg days to offer (from 14 days last quarter & 14 days in Q3 - 2022)

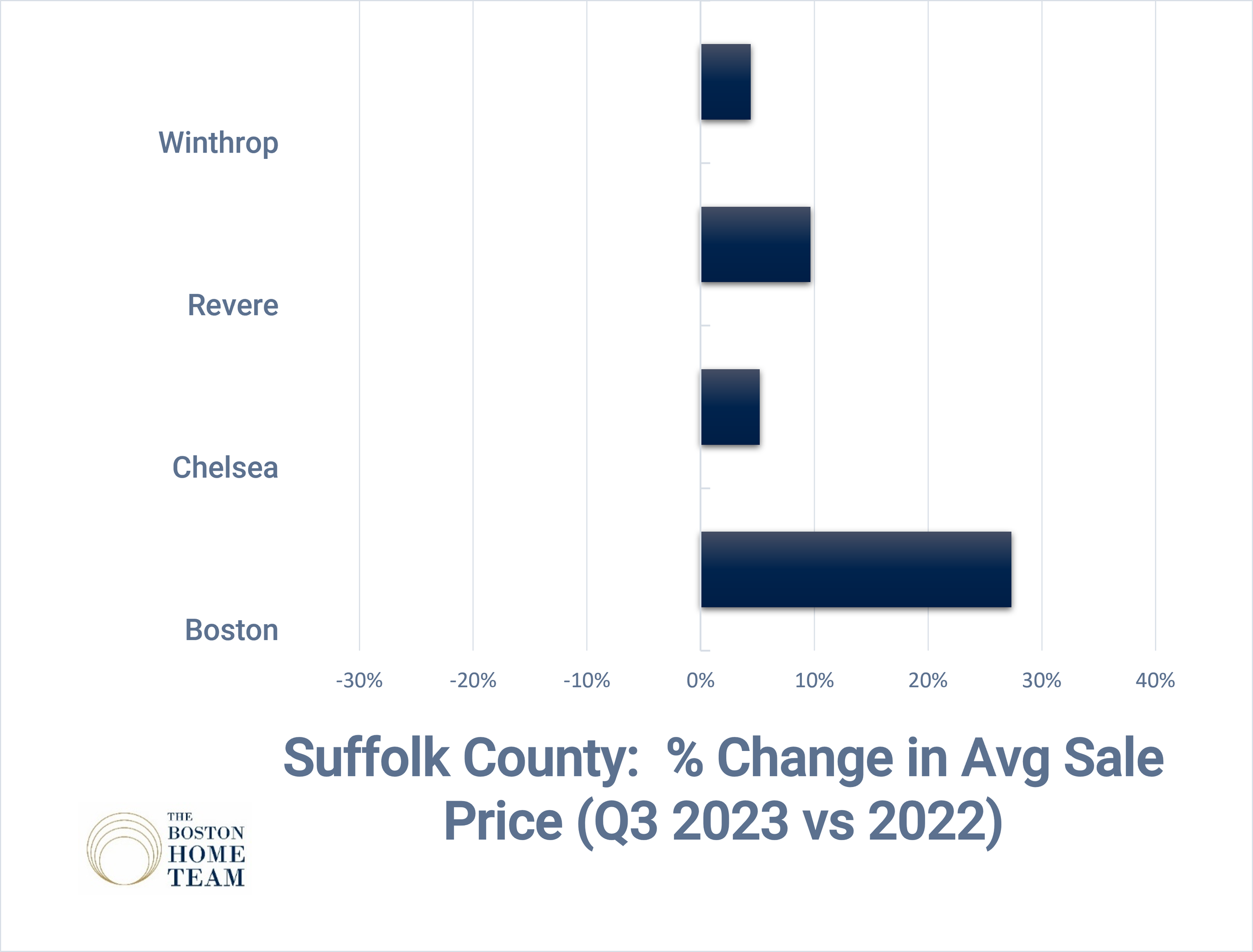

Chelsea: 5 single families sold - up from 4 (25%) last qtr and down -68.75% from last year.

Avg Sale Price: $521K (down -2.27% from last quarter, and down -3.36% from last year).

Avg $$$/SQFT: $349 (down -10.95% from last quarter, and down -2% from last year).

Sale to List Ratio: 110.08% (106.02% last quarter & 102.78% in Q3 - 2022)

40 avg days to offer (from 24 days last quarter & 19 days in Q3 - 2022)

Concord: 45 single families sold - down from 47 (-4.3%) last qtr and down -22.41% from last year.

Avg Sale Price: $1.81M (up 0.99% from last quarter, and up 6.64% from last year).

Avg $$$/SQFT: $522 (down -0.49% from last quarter, and up 4.78% from last year).

Sale to List Ratio: 105% (103.63% last quarter & 103.56% in Q3 - 2022)

25 avg days to offer (from 29 days last quarter & 13 days in Q3 - 2022)

Danvers: 38 single families sold - down from 47 (-19.1%) last qtr and down -35.59% from last year.

Avg Sale Price: $757.1K (up 3.98% from last quarter, and up 8.03% from last year).

Avg $$$/SQFT: $383 (up 5.2% from last quarter, and up 12.83% from last year).

Sale to List Ratio: 103.35% (104.41% last quarter & 102.25% in Q3 - 2022)

15 avg days to offer (from 17 days last quarter & 16 days in Q3 - 2022)

Dedham: 53 single families sold - down from 59 (-10.2%) last qtr and down -32.91% from last year.

Avg Sale Price: $823K (up 5.66% from last quarter, and up 3.38% from last year).

Avg $$$/SQFT: $413 (down -2.07% from last quarter, and up 2.14% from last year).

Sale to List Ratio: 103.77% (106.12% last quarter & 101.26% in Q3 - 2022)

14 avg days to offer (from 10 days last quarter & 18 days in Q3 - 2022)

Dorchester: 20 single families sold - up from 19 (5.3%) last qtr and down -56.52% from last year.

Avg Sale Price: $758.3K (down -8.85% from last quarter, and down -0.96% from last year).

Avg $$$/SQFT: $436 (up 7.86% from last quarter, and up 5.57% from last year).

Sale to List Ratio: 101.09% (99.28% last quarter & 99.66% in Q3 - 2022)

39 avg days to offer (from 95 days last quarter & 28 days in Q3 - 2022)

Everett: 18 single families sold - down from 19 (-5.3%) last qtr and down -10% from last year.

Avg Sale Price: $659K (up 13.21% from last quarter, and up 10.8% from last year).

Avg $$$/SQFT: $412 (up 6.02% from last quarter, and up 16.14% from last year).

Sale to List Ratio: 103.15% (105.09% last quarter & 104.06% in Q3 - 2022)

17 avg days to offer (from 26 days last quarter & 22 days in Q3 - 2022)

Framingham: 122 single families sold - up from 85 (43.5%) last qtr and down -22.78% from last year.

Avg Sale Price: $713.5K (up 7.86% from last quarter, and up 9.12% from last year).

Avg $$$/SQFT: $354 (down -2.56% from last quarter, and up 4.96% from last year).

Sale to List Ratio: 105.95% (107.75% last quarter & 103.37% in Q3 - 2022)

11 avg days to offer (from 11 days last quarter & 12 days in Q3 - 2022)

Hamilton: 13 single families sold - down from 20 (-35%) last qtr and down -48% from last year.

Avg Sale Price: $1M (up 3.1% from last quarter, and up 3.25% from last year).

Avg $$$/SQFT: $414 (down -2.97% from last quarter, and up 2.17% from last year).

Sale to List Ratio: 100.47% (105.38% last quarter & 104.54% in Q3 - 2022)

38 avg days to offer (from 28 days last quarter & 13 days in Q3 - 2022)

Holbrook: 21 single families sold - down from 43 (-51.2%) last qtr and down -36.36% from last year.

Avg Sale Price: $497.2K (down -5.78% from last quarter, and up 4.51% from last year).

Avg $$$/SQFT: $338 (down -4.42% from last quarter, and up 7.71% from last year).

Sale to List Ratio: 102.25% (105.13% last quarter & 102.15% in Q3 - 2022)

14 avg days to offer (from 20 days last quarter & 15 days in Q3 - 2022)

Hyde Park: 31 single families sold - up from 26 (19.2%) last qtr and down -3.13% from last year.

Avg Sale Price: $628.7K (up 2.9% from last quarter, and down -8.1% from last year).

Avg $$$/SQFT: $389 (down -27.7% from last quarter, and down -3.24% from last year).

Sale to List Ratio: 102.62% (102.48% last quarter & 101.22% in Q3 - 2022)

18 avg days to offer (from 31 days last quarter & 15 days in Q3 - 2022)

Jamaica Plain: 13 single families sold - 0 13 (0%) last qtr and down -13.33% from last year.

Avg Sale Price: $1.07M (down -28% from last quarter, and down -26.51% from last year).

Avg $$$/SQFT: $640 (up 2.05% from last quarter, and up 7.95% from last year).

Sale to List Ratio: 104.54% (112.23% last quarter & 104.48% in Q3 - 2022)

32 avg days to offer (from 23 days last quarter & 15 days in Q3 - 2022)

Lincoln: 12 single families sold - 0 12 (0%) last qtr and up 20% from last year.

Avg Sale Price: $1.48M (down -12.97% from last quarter, and down -18.34% from last year).

Avg $$$/SQFT: $472 (up 1.16% from last quarter, and down -8.21% from last year).

Sale to List Ratio: 102.16% (106.53% last quarter & 106.1% in Q3 - 2022)

16 avg days to offer (from 19 days last quarter & 18 days in Q3 - 2022)

Lynn: 81 single families sold - up from 78 (3.8%) last qtr and down -30.17% from last year.

Avg Sale Price: $567.7K (up 1.88% from last quarter, and up 11.45% from last year).

Avg $$$/SQFT: $378 (up 2.39% from last quarter, and up 5.19% from last year).

Sale to List Ratio: 105.36% (104.78% last quarter & 104.28% in Q3 - 2022)

12 avg days to offer (from 14 days last quarter & 12 days in Q3 - 2022)

Lynnfield: 30 single families sold - up from 24 (25%) last qtr and down -21.05% from last year.

Avg Sale Price: $1.22M (up 10.85% from last quarter, and up 23.02% from last year).

Avg $$$/SQFT: $377 (down -6.14% from last quarter, and down -2.96% from last year).

Sale to List Ratio: 103.61% (104.25% last quarter & 104.29% in Q3 - 2022)

21 avg days to offer (from 18 days last quarter & 14 days in Q3 - 2022)

Malden: 47 single families sold - up from 33 (42.4%) last qtr and down -34.72% from last year.

Avg Sale Price: $670.6K (down -1.22% from last quarter, and up 9.74% from last year).

Avg $$$/SQFT: $415 (down -2.9% from last quarter, and up 0.77% from last year).

Sale to List Ratio: 106.95% (107.98% last quarter & 104.64% in Q3 - 2022)

15 avg days to offer (from 12 days last quarter & 11 days in Q3 - 2022)

Marblehead: 57 single families sold - up from 42 (35.7%) last qtr and down -22.97% from last year.

Avg Sale Price: $1.23M (up 7.54% from last quarter, and down -2.15% from last year).

Avg $$$/SQFT: $551 (up 16.76% from last quarter, and up 9.23% from last year).

Sale to List Ratio: 105.04% (101.76% last quarter & 104.89% in Q3 - 2022)

18 avg days to offer (from 22 days last quarter & 10 days in Q3 - 2022)

Mattapan: 6 single families sold - 0 6 (0%) last qtr and up 20% from last year.

Avg Sale Price: $652K (up 12.9% from last quarter, and up 16.63% from last year).

Avg $$$/SQFT: $328 (down -14.71% from last quarter, and down -1.36% from last year).

Sale to List Ratio: 104.71% (99.17% last quarter & 102.69% in Q3 - 2022)

24 avg days to offer (from 55 days last quarter & 11 days in Q3 - 2022)

Melrose: 42 single families sold - down from 54 (-22.2%) last qtr and down -41.67% from last year.

Avg Sale Price: $975.8K (up 9.7% from last quarter, and up 14.61% from last year).

Avg $$$/SQFT: $472 (up 4.85% from last quarter, and up 1.52% from last year).

Sale to List Ratio: 105.16% (107.53% last quarter & 105.55% in Q3 - 2022)

19 avg days to offer (from 9 days last quarter & 13 days in Q3 - 2022)

Milton: 49 single families sold - up from 42 (16.7%) last qtr and down -27.94% from last year.

Avg Sale Price: $1.18M (up 4.64% from last quarter, and up 7.92% from last year).

Avg $$$/SQFT: $474 (up 0.59% from last quarter, and up 5.11% from last year).

Sale to List Ratio: 103.72% (105.97% last quarter & 101.93% in Q3 - 2022)

14 avg days to offer (from 13 days last quarter & 20 days in Q3 - 2022)

Nahant: 10 single families sold - up from 9 (11.1%) last qtr and down -23.08% from last year.

Avg Sale Price: $1.18M (up 29.64% from last quarter, and up 0.81% from last year).

Avg $$$/SQFT: $505 (up 8.24% from last quarter, and down -7.94% from last year).

Sale to List Ratio: 98.23% (97.76% last quarter & 96.98% in Q3 - 2022)

45 avg days to offer (from 17 days last quarter & 25 days in Q3 - 2022)

Natick: 63 single families sold - down from 85 (-25.9%) last qtr and down -16% from last year.

Avg Sale Price: $1.13M (up 4.3% from last quarter, and up 13.88% from last year).

Avg $$$/SQFT: $438 (down -1.66% from last quarter, and up 0.71% from last year).

Sale to List Ratio: 103.19% (104.47% last quarter & 102.77% in Q3 - 2022)

22 avg days to offer (from 22 days last quarter & 16 days in Q3 - 2022)

Needham: 70 single families sold - down from 74 (-5.4%) last qtr and down -14.63% from last year.

Avg Sale Price: $1.83M (up 18.87% from last quarter, and up 8.19% from last year).

Avg $$$/SQFT: $489 (down -7.92% from last quarter, and down -6.21% from last year).

Sale to List Ratio: 102.82% (104.3% last quarter & 102.01% in Q3 - 2022)

21 avg days to offer (from 15 days last quarter & 15 days in Q3 - 2022)

Newton: 129 single families sold - down from 150 (-14%) last qtr and down -22.75% from last year.

Avg Sale Price: $2.07M (up 3.78% from last quarter, and down -0.26% from last year).

Avg $$$/SQFT: $585 (down -0.19% from last quarter, and up 2.56% from last year).

Sale to List Ratio: 101.7% (102.6% last quarter & 101.43% in Q3 - 2022)

23 avg days to offer (from 21 days last quarter & 24 days in Q3 - 2022)

Norwood: 48 single families sold - down from 54 (-11.1%) last qtr and down -23.81% from last year.

Avg Sale Price: $693.8K (down -1.29% from last quarter, and up 3.74% from last year).

Avg $$$/SQFT: $427 (up 1.42% from last quarter, and up 8.41% from last year).

Sale to List Ratio: 102.97% (105.89% last quarter & 101.94% in Q3 - 2022)

15 avg days to offer (from 10 days last quarter & 17 days in Q3 - 2022)

Peabody: 64 single families sold - down from 65 (-1.5%) last qtr and down -35.35% from last year.

Avg Sale Price: $671.3K (up 3.43% from last quarter, and up 4.01% from last year).

Avg $$$/SQFT: $375 (down -2.27% from last quarter, and up 5.94% from last year).

Sale to List Ratio: 104.65% (104.7% last quarter & 103.22% in Q3 - 2022)

10 avg days to offer (from 14 days last quarter & 13 days in Q3 - 2022)

Quincy: 94 single families sold - up from 63 (49.2%) last qtr and down -27.13% from last year.

Avg Sale Price: $714.3K (up 2.28% from last quarter, and down -0.17% from last year).

Avg $$$/SQFT: $429 (down -0.28% from last quarter, and down -1.26% from last year).

Sale to List Ratio: 102.63% (104.29% last quarter & 103.31% in Q3 - 2022)

16 avg days to offer (from 18 days last quarter & 16 days in Q3 - 2022)

Randolph: 30 single families sold - down from 39 (-23.1%) last qtr and down -55.22% from last year.

Avg Sale Price: $619.4K (up 11% from last quarter, and up 17.08% from last year).

Avg $$$/SQFT: $357 (up 10.62% from last quarter, and up 6.2% from last year).

Sale to List Ratio: 104.64% (105.06% last quarter & 103.94% in Q3 - 2022)

18 avg days to offer (from 16 days last quarter & 16 days in Q3 - 2022)

Revere: 40 single families sold - up from 35 (14.3%) last qtr and down -16.67% from last year.

Avg Sale Price: $658.7K (up 13.1% from last quarter, and up 6.72% from last year).

Avg $$$/SQFT: $357 (up 4.82% from last quarter, and down -2.1% from last year).

Sale to List Ratio: 101.67% (103.05% last quarter & 103.95% in Q3 - 2022)

13 avg days to offer (from 15 days last quarter & 8 days in Q3 - 2022)

Roslindale: 22 single families sold - down from 28 (-21.4%) last qtr and down -37.14% from last year.

Avg Sale Price: $887.1K (up 8.76% from last quarter, and up 7.95% from last year).

Avg $$$/SQFT: $489 (up 2.87% from last quarter, and up 7.86% from last year).

Sale to List Ratio: 104.06% (103.96% last quarter & 104.74% in Q3 - 2022)

15 avg days to offer (from 20 days last quarter & 13 days in Q3 - 2022)

Salem: 28 single families sold - down from 47 (-40.4%) last qtr and down -59.42% from last year.

Avg Sale Price: $659.1K (up 2.62% from last quarter, and down -0.4% from last year).

Avg $$$/SQFT: $405 (up 15.67% from last quarter, and up 11.07% from last year).

Sale to List Ratio: 104.77% (104.64% last quarter & 105.83% in Q3 - 2022)

10 avg days to offer (from 21 days last quarter & 13 days in Q3 - 2022)

Sharon: 48 single families sold - up from 39 (23.1%) last qtr and down -30.43% from last year.

Avg Sale Price: $828.5K (down -9.11% from last quarter, and down -4.93% from last year).

Avg $$$/SQFT: $380 (up 4.76% from last quarter, and up 10.18% from last year).

Sale to List Ratio: 103.1% (101.42% last quarter & 100.41% in Q3 - 2022)

17 avg days to offer (from 13 days last quarter & 23 days in Q3 - 2022)

Somerville: 19 single families sold - 0 19 (0%) last qtr and down -29.63% from last year.

Avg Sale Price: $1.11M (down -23.01% from last quarter, and down -10.25% from last year).

Avg $$$/SQFT: $737 (up 9.19% from last quarter, and up 12.25% from last year).

Sale to List Ratio: 101.22% (104.13% last quarter & 103.83% in Q3 - 2022)

52 avg days to offer (from 18 days last quarter & 13 days in Q3 - 2022)

Swampscott: 16 single families sold - down from 21 (-23.8%) last qtr and down -58.97% from last year.

Avg Sale Price: $974.1K (down -18.6% from last quarter, and down -1.93% from last year).

Avg $$$/SQFT: $401 (down -2.02% from last quarter, and down -1.29% from last year).

Sale to List Ratio: 99.19% (103.09% last quarter & 104.79% in Q3 - 2022)

33 avg days to offer (from 25 days last quarter & 13 days in Q3 - 2022)

Topsfield: 17 single families sold - 0 17 (0%) last qtr and down -26.09% from last year.

Avg Sale Price: $878.7K (down -2.35% from last quarter, and up 1.42% from last year).

Avg $$$/SQFT: $347 (down -5.95% from last quarter, and down -1.18% from last year).

Sale to List Ratio: 101.41% (108.07% last quarter & 102.67% in Q3 - 2022)

14 avg days to offer (from 7 days last quarter & 18 days in Q3 - 2022)

Wakefield: 48 single families sold - down from 51 (-5.9%) last qtr and down -29.41% from last year.

Avg Sale Price: $835.5K (down -1.35% from last quarter, and up 10.41% from last year).

Avg $$$/SQFT: $390 (down -3.19% from last quarter, and down -0.21% from last year).

Sale to List Ratio: 105.61% (108.89% last quarter & 104.69% in Q3 - 2022)

14 avg days to offer (from 11 days last quarter & 12 days in Q3 - 2022)

Walpole: 43 single families sold - up from 39 (10.3%) last qtr and down -12.24% from last year.

Avg Sale Price: $881.5K (up 7.4% from last quarter, and up 7.25% from last year).

Avg $$$/SQFT: $373 (down -0.15% from last quarter, and up 10.22% from last year).

Sale to List Ratio: 105.24% (106.95% last quarter & 104.7% in Q3 - 2022)

12 avg days to offer (from 7 days last quarter & 9 days in Q3 - 2022)

Waltham: 64 single families sold - down from 65 (-1.5%) last qtr and down -24.71% from last year.

Avg Sale Price: $887K (down -0.66% from last quarter, and up 15.43% from last year).

Avg $$$/SQFT: $430 (down -6.41% from last quarter, and up 3.41% from last year).

Sale to List Ratio: 103.92% (104.16% last quarter & 102.75% in Q3 - 2022)

14 avg days to offer (from 21 days last quarter & 14 days in Q3 - 2022)

Watertown: 12 single families sold - down from 19 (-36.8%) last qtr and down -45.45% from last year.

Avg Sale Price: $951.7K (down -22.64% from last quarter, and down -13.56% from last year).

Avg $$$/SQFT: $583 (up 9.61% from last quarter, and up 13.46% from last year).

Sale to List Ratio: 104.95% (104.56% last quarter & 105.05% in Q3 - 2022)

13 avg days to offer (from 14 days last quarter & 15 days in Q3 - 2022)

Wellesley: 61 single families sold - down from 78 (-21.8%) last qtr and down -31.46% from last year.

Avg Sale Price: $2.38M (up 1.01% from last quarter, and up 22.55% from last year).

Avg $$$/SQFT: $615 (down -2.17% from last quarter, and up 2.2% from last year).

Sale to List Ratio: 100.43% (105.17% last quarter & 103.26% in Q3 - 2022)

32 avg days to offer (from 19 days last quarter & 10 days in Q3 - 2022)

West Roxbury: 50 single families sold - down from 64 (-21.9%) last qtr and down -36.71% from last year.

Avg Sale Price: $908.8K (up 4.99% from last quarter, and down -0.77% from last year).

Avg $$$/SQFT: $493 (down -0.18% from last quarter, and up 3.34% from last year).

Sale to List Ratio: 103.03% (103.61% last quarter & 103.01% in Q3 - 2022)

15 avg days to offer (from 21 days last quarter & 17 days in Q3 - 2022)

Weston: 36 single families sold - down from 45 (-20%) last qtr and down -5.26% from last year.

Avg Sale Price: $3.12M (up 10.42% from last quarter, and up 29.31% from last year).

Avg $$$/SQFT: $590 (up 1.24% from last quarter, and up 9.9% from last year).

Sale to List Ratio: 101.87% (102.51% last quarter & 103.78% in Q3 - 2022)

45 avg days to offer (from 43 days last quarter & 20 days in Q3 - 2022)

Westwood: 25 single families sold - down from 40 (-37.5%) last qtr and down -53.7% from last year.

Avg Sale Price: $1.13M (down -29.82% from last quarter, and down -18.09% from last year).

Avg $$$/SQFT: $514 (up 12.38% from last quarter, and up 7.9% from last year).

Sale to List Ratio: 103.46% (102.89% last quarter & 102.33% in Q3 - 2022)

21 avg days to offer (from 45 days last quarter & 15 days in Q3 - 2022)

Winchester: 43 single families sold - down from 55 (-21.8%) last qtr and down -30.65% from last year.

Avg Sale Price: $1.45M (down -17.59% from last quarter, and down -12.74% from last year).

Avg $$$/SQFT: $558 (up 8.08% from last quarter, and up 7.82% from last year).

Sale to List Ratio: 99.89% (102.75% last quarter & 102.84% in Q3 - 2022)

26 avg days to offer (from 15 days last quarter & 22 days in Q3 - 2022)

Winthrop: 12 single families sold - down from 15 (-20%) last qtr and down -52% from last year.

Avg Sale Price: $729.5K (up 0.12% from last quarter, and up 5.04% from last year).

Avg $$$/SQFT: $409 (up 1.92% from last quarter, and down -3.74% from last year).

Sale to List Ratio: 102.64% (100.93% last quarter & 101.12% in Q3 - 2022)

13 avg days to offer (from 42 days last quarter & 22 days in Q3 - 2022)

As always, we’re here for all your real estate needs. If we can’t assist directly, we KNOW someone you can trust who can.