The Q3-2023 Real Estate Numbers Are In - Condominium Edition

How did your town or neighborhood fare?

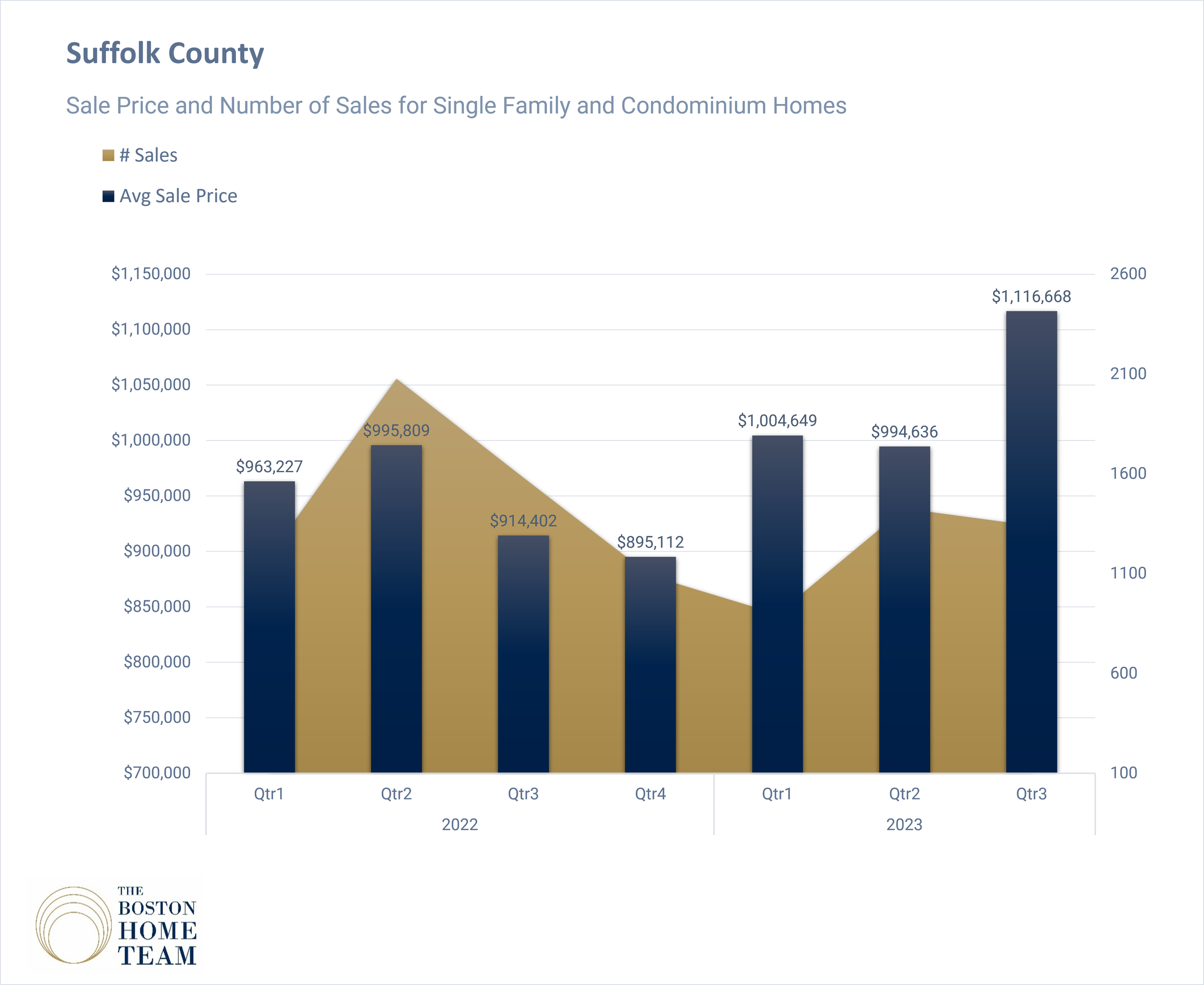

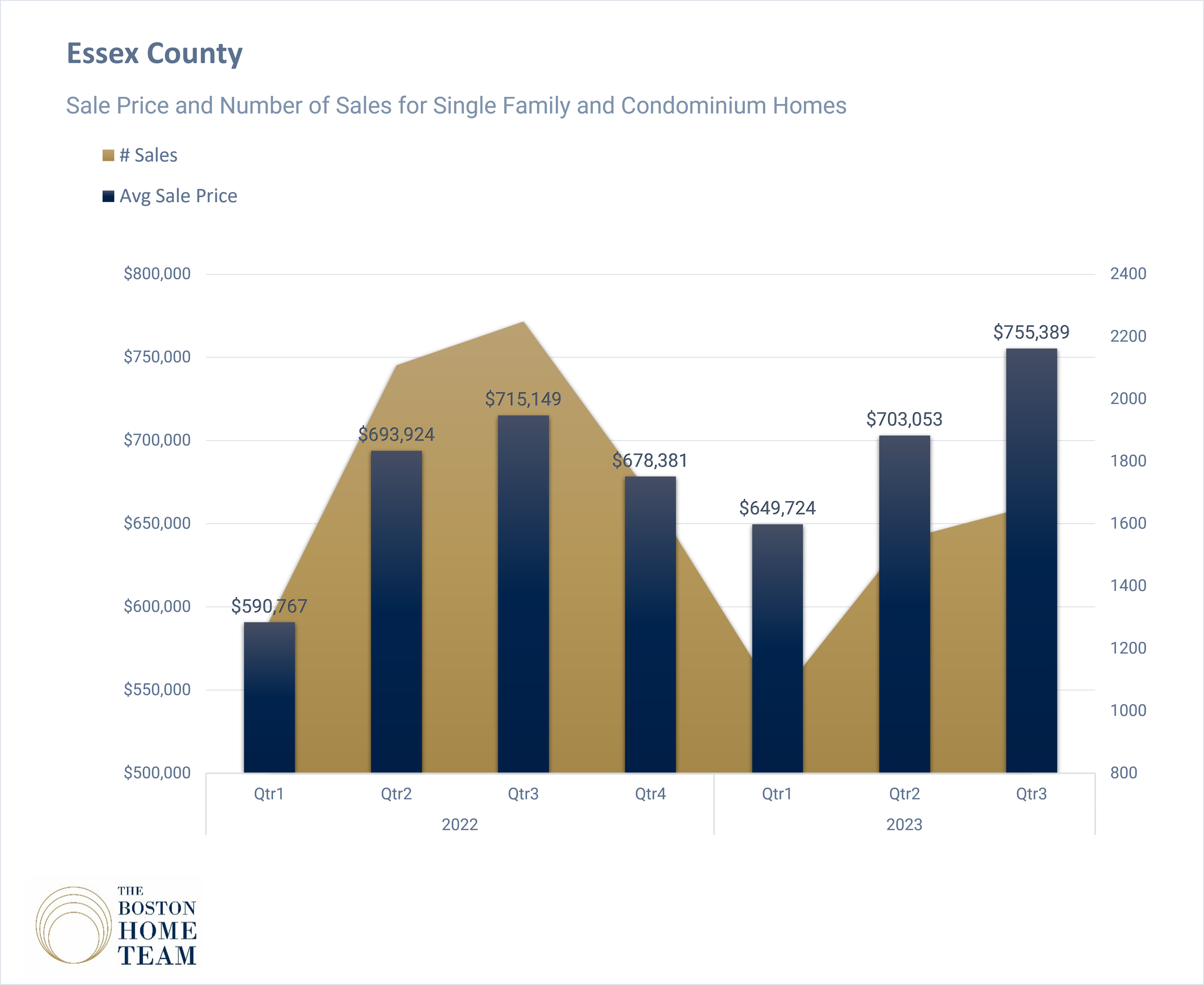

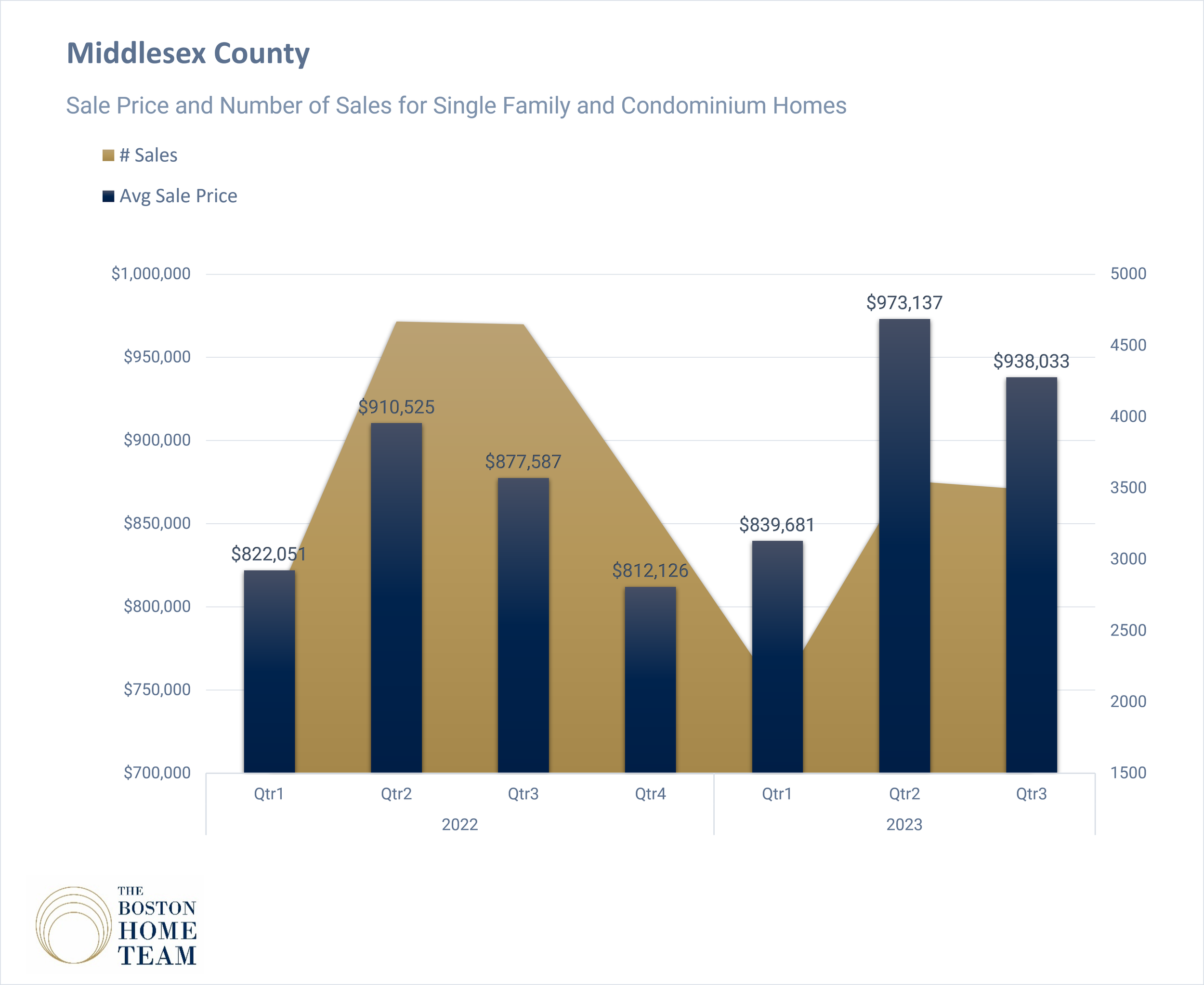

We pulled the sales numbers from MLS and compared this most recent (Q3-2023) to the previous quarter and the same quarter last year. Since we cover a broad variety of different markets over 4-5 counties, we selected the condo sales data from a handful of towns and Boston neighborhoods.

Other than the shrinking inventory which, with few exceptions, is the case for for most of the markets, there aren’t many other overarching trends we can report on. Some areas are seeing prices drop while market time rises. Others are experiencing record price jumps. It’s why we always say to take national or regional Real Estate market reporting with a big shiny grain of sea salt, because Real Estate is local. When we’re working with clients in a specific area we never assume that any market data is iterative.

Below you’ll find a breakdown, town by town, of this past quarter’s performance. Speckled in you’ll also find some of Boston’s neighborhoods since they are much like their own towns and often vary in their market performance.

But first, some highlights from this report. This is for condos only. If you’d like to view the single family report, click here. And yes, I asked AI to read our data table to give us the highlights.

Biggest Changes:

Allston: Condo sales were down significantly by 48.8% compared to the last quarter but up 10% from the previous year. The average sale price also dropped by 22.6% from the last quarter.

Seaport District: Condo sales saw a dramatic decrease of 45.5% compared to the last quarter but a staggering 102.55% increase from the previous year in average sale price.

Melrose: Condo sales decreased by 52% from the last quarter and 60% from the previous year in average sale price.

Most Dramatic Improvements:

Financial District: Condo sales were up by an impressive 300% compared to the last quarter, with an astonishing 182.57% increase in average sale price from the previous year.

Lynn: Condo sales increased by 66.7% from the last quarter, with a substantial 27.63% increase in average sale price from the previous year.

Dedham: Condo sales were up by 66.67% from the last quarter, with a remarkable 41.74% increase in average sale price from the previous year.

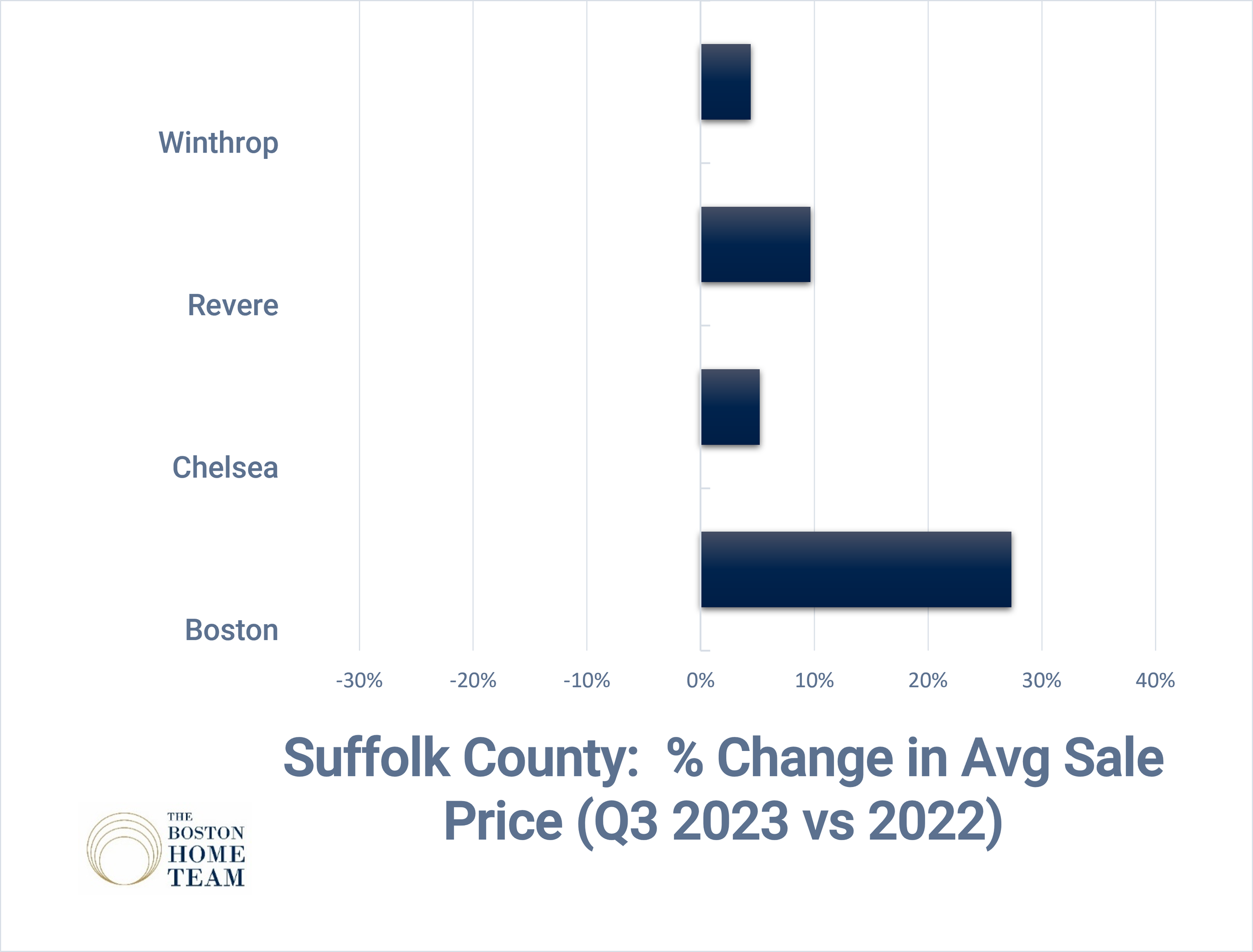

Revere: Condo sales increased by 66.7% from the last quarter, with an 8.5% increase in average sale price from the previous year.

Chelsea: Condo sales increased by 20% from the last quarter, with a 14.57% increase in average sale price from the previous year.

Most Promising Trends:

South Boston: While condo sales were up only 2% compared to the last quarter, it's worth noting that the area saw an increase in average sale price both from the last quarter and the previous year.

Quincy: Condo sales increased by 14.9% from the last quarter, and the average sale price also showed positive growth from both the last quarter and the previous year.

Salem: Despite a significant increase in condo sales from the last quarter, there was also an uptick in the average sale price from the previous year.

Medford: Condo sales were down slightly, but the average sale price increased from both the last quarter and the previous year.

Brighton: Condo sales were down from the last quarter, but there was a notable increase in average sale price compared to the previous year.

Least Promising Trends:

Melrose: With a sharp drop in condo sales and average sale price, the market in Melrose appears less promising in this quarter's data.

Allston: Despite a slight increase in condo sales from the previous year, the sharp decline in average sale price may raise concerns.

Seaport District: While the average sale price soared, the drop in condo sales might suggest a less stable market.

East Boston: With a significant decrease in condo sales and average sale price from the previous year, the market in East Boston appears less promising in this quarter's data.

Q3 - 2023 Essex, Middlesex, Norfolk, and Suffolk County Summary - Select Towns & Neighborhoods Condo Market Summary - (Alphabetical)

Allston: 22 condos sold - down from 43 (-48.8%) last qtr and up 10% from last year.

Avg Sale Price: $597.5K (down -22.6% from last quarter, and up 13.96% from last year).

Avg $$$/SQFT: $708 (down -18.15% from last quarter, and up 17.4% from last year).

Sale to List Ratio: 99.74% (100.22% last quarter & 99.36% in Q3 - 2022)

33 avg days to offer (from 35 days last quarter & 18 days in Q3 - 2022)

Arlington: 46 condos sold - down from 62 (-25.8%) last qtr and down -22.03% from last year.

Avg Sale Price: $858.3K (up 3.68% from last quarter, and up 10.48% from last year).

Avg $$$/SQFT: $556 (up 0.27% from last quarter, and up 5.22% from last year).

Sale to List Ratio: 104.95% (105.6% last quarter & 101.7% in Q3 - 2022)

10 avg days to offer (from 17 days last quarter & 21 days in Q3 - 2022)

Back Bay: 114 condos sold - up from 101 (12.9%) last qtr and up 46.15% from last year.

Avg Sale Price: $2.94M (up 70.17% from last quarter, and up 93.23% from last year).

Avg $$$/SQFT: $1770 (up 35.5% from last quarter, and up 41.01% from last year).

Sale to List Ratio: 98.36% (97.76% last quarter & 97.5% in Q3 - 2022)

41 avg days to offer (from 46 days last quarter & 45 days in Q3 - 2022)

Beacon Hill: 33 condos sold - up from 31 (6.5%) last qtr and up 17.86% from last year.

Avg Sale Price: $1.77M (up 17.36% from last quarter, and up 21.64% from last year).

Avg $$$/SQFT: $1266 (down -1% from last quarter, and up 7.06% from last year).

Sale to List Ratio: 99.45% (98.89% last quarter & 97.36% in Q3 - 2022)

44 avg days to offer (from 18 days last quarter & 30 days in Q3 - 2022)

Belmont: 13 condos sold - down from 16 (-18.8%) last qtr and down -48% from last year.

Avg Sale Price: $735.8K (down -11.78% from last quarter, and down -12.75% from last year).

Avg $$$/SQFT: $579 (up 14.02% from last quarter, and up 12.18% from last year).

Sale to List Ratio: 102.5% (102.68% last quarter & 105.16% in Q3 - 2022)

15 avg days to offer (from 14 days last quarter & 11 days in Q3 - 2022)

Beverly: 26 condos sold - up from 24 (8.3%) last qtr and down -43.48% from last year.

Avg Sale Price: $517.3K (up 4.23% from last quarter, and up 6.25% from last year).

Avg $$$/SQFT: $418 (down -2.83% from last quarter, and up 6.66% from last year).

Sale to List Ratio: 104.75% (106.42% last quarter & 101.97% in Q3 - 2022)

9 avg days to offer (from 18 days last quarter & 14 days in Q3 - 2022)

Brighton: 84 condos sold - down from 105 (-20%) last qtr and up 9.09% from last year.

Avg Sale Price: $601.7K (down -16.36% from last quarter, and up 5.58% from last year).

Avg $$$/SQFT: $739 (down -12.8% from last quarter, and up 4.68% from last year).

Sale to List Ratio: 101.11% (100.95% last quarter & 99.86% in Q3 - 2022)

21 avg days to offer (from 20 days last quarter & 23 days in Q3 - 2022)

Brookline: 106 condos sold - down from 138 (-23.2%) last qtr and up 4.95% from last year.

Avg Sale Price: $1.15M (down -5.34% from last quarter, and up 8.7% from last year).

Avg $$$/SQFT: $777 (down -6.41% from last quarter, and down -0.36% from last year).

Sale to List Ratio: 99.86% (100.52% last quarter & 99.87% in Q3 - 2022)

23 avg days to offer (from 27 days last quarter & 27 days in Q3 - 2022)

Cambridge: 141 condos sold - down from 182 (-22.5%) last qtr and down -1.4% from last year.

Avg Sale Price: $1.06M (down -3.45% from last quarter, and down -3.39% from last year).

Avg $$$/SQFT: $939 (up 3.77% from last quarter, and up 5.13% from last year).

Sale to List Ratio: 101.31% (102.51% last quarter & 101.24% in Q3 - 2022)

27 avg days to offer (from 23 days last quarter & 20 days in Q3 - 2022)

Charlestown: 43 condos sold - down from 66 (-34.8%) last qtr and down -36.76% from last year.

Avg Sale Price: $884.4K (down -10.44% from last quarter, and down -3.3% from last year).

Avg $$$/SQFT: $839 (up 0.38% from last quarter, and up 3.34% from last year).

Sale to List Ratio: 100.03% (100.29% last quarter & 100.09% in Q3 - 2022)

14 avg days to offer (from 19 days last quarter & 18 days in Q3 - 2022)

Chelsea: 24 condos sold - up from 20 (20%) last qtr and down -11.11% from last year.

Avg Sale Price: $482.6K (up 8.53% from last quarter, and up 14.57% from last year).

Avg $$$/SQFT: $416 (down -12.35% from last quarter, and up 2.33% from last year).

Sale to List Ratio: 101.73% (102.18% last quarter & 102.18% in Q3 - 2022)

23 avg days to offer (from 14 days last quarter & 16 days in Q3 - 2022)

Chestnut Hill: 5 condos sold - up from 2 (150%) last qtr and up 25% from last year.

Avg Sale Price: $624.4K (up 36.93% from last quarter, and down -7.67% from last year).

Avg $$$/SQFT: $441 (down -11.71% from last quarter, and down -9.3% from last year).

Sale to List Ratio: 101.84% (101.83% last quarter & 98.41% in Q3 - 2022)

15 avg days to offer (from 20 days last quarter & 26 days in Q3 - 2022)

Dedham: 10 condos sold - up from 6 (66.7%) last qtr and up 66.67% from last year.

Avg Sale Price: $572.1K (up 22.4% from last quarter, and up 41.74% from last year).

Avg $$$/SQFT: $399 (up 15.36% from last quarter, and up 0.43% from last year).

Sale to List Ratio: 101.87% (104.11% last quarter & 102.5% in Q3 - 2022)

21 avg days to offer (from 9 days last quarter & 31 days in Q3 - 2022)

Dorchester: 75 condos sold - down from 93 (-19.4%) last qtr and down -7.41% from last year.

Avg Sale Price: $597.1K (down -7.87% from last quarter, and up 3.98% from last year).

Avg $$$/SQFT: $521 (down -1.24% from last quarter, and up 2.8% from last year).

Sale to List Ratio: 101.34% (101.14% last quarter & 99.59% in Q3 - 2022)

21 avg days to offer (from 23 days last quarter & 21 days in Q3 - 2022)

East Boston: 63 condos sold - down from 79 (-20.3%) last qtr and down -41.67% from last year.

Avg Sale Price: $608.3K (down -10.71% from last quarter, and down -6.23% from last year).

Avg $$$/SQFT: $614 (down -8.92% from last quarter, and down -16.41% from last year).

Sale to List Ratio: 99.86% (100.52% last quarter & 99.42% in Q3 - 2022)

28 avg days to offer (from 36 days last quarter & 19 days in Q3 - 2022)

Everett: 12 condos sold - up from 7 (71.4%) last qtr and down -29.41% from last year.

Avg Sale Price: $518K (up 22.55% from last quarter, and up 17.98% from last year).

Avg $$$/SQFT: $469 (up 9.28% from last quarter, and up 29.45% from last year).

Sale to List Ratio: 101.14% (101.48% last quarter & 100.96% in Q3 - 2022)

15 avg days to offer (from 34 days last quarter & 43 days in Q3 - 2022)

Financial District: 4 condos sold - up from 1 (300%) last qtr and up 100% from last year.

Avg Sale Price: $1.84M (up 5.36% from last quarter, and up 182.57% from last year).

Avg $$$/SQFT: $1384 (up 23.05% from last quarter, and up 68.19% from last year).

Sale to List Ratio: 99.38% (92.2% last quarter & 96.74% in Q3 - 2022)

49 avg days to offer (from 185 days last quarter & 190 days in Q3 - 2022)

Framingham: 28 condos sold - down from 35 (-20%) last qtr and down -26.32% from last year.

Avg Sale Price: $451.3K (down -22.15% from last quarter, and down -7.63% from last year).

Avg $$$/SQFT: $370 (up 1.25% from last quarter, and up 7.61% from last year).

Sale to List Ratio: 103.63% (105.31% last quarter & 105.68% in Q3 - 2022)

14 avg days to offer (from 17 days last quarter & 15 days in Q3 - 2022)

Hyde Park: 10 condos sold - down from 11 (-9.1%) last qtr and down -47.37% from last year.

Avg Sale Price: $378.1K (up 0.58% from last quarter, and down -13.65% from last year).

Avg $$$/SQFT: $371 (up 1.9% from last quarter, and up 1.64% from last year).

Sale to List Ratio: 101.32% (98.89% last quarter & 103.34% in Q3 - 2022)

32 avg days to offer (from 31 days last quarter & 19 days in Q3 - 2022)

Jamaica Plain: 88 condos sold - down from 97 (-9.3%) last qtr and down -7.37% from last year.

Avg Sale Price: $674.7K (down -9.31% from last quarter, and down -9.99% from last year).

Avg $$$/SQFT: $606 (down -5.29% from last quarter, and down -0.74% from last year).

Sale to List Ratio: 101.5% (103.81% last quarter & 103.09% in Q3 - 2022)

32 avg days to offer (from 17 days last quarter & 13 days in Q3 - 2022)

Lowell: 57 condos sold - down from 68 (-16.2%) last qtr and down -44.12% from last year.

Avg Sale Price: $349.9K (up 3.55% from last quarter, and up 7.52% from last year).

Avg $$$/SQFT: $304 (up 1.21% from last quarter, and up 7.49% from last year).

Sale to List Ratio: 104.91% (103.4% last quarter & 104.64% in Q3 - 2022)

11 avg days to offer (from 20 days last quarter & 20 days in Q3 - 2022)

Lynn: 25 condos sold - down from 33 (-24.2%) last qtr and down -35.9% from last year.

Avg Sale Price: $428.6K (up 22.93% from last quarter, and up 27.63% from last year).

Avg $$$/SQFT: $526 (up 50.12% from last quarter, and up 54.05% from last year).

Sale to List Ratio: 137.39% (103.21% last quarter & 102.85% in Q3 - 2022)

22 avg days to offer (from 14 days last quarter & 14 days in Q3 - 2022)

Malden: 30 condos sold - up from 23 (30.4%) last qtr and down -25% from last year.

Avg Sale Price: $470K (down -2.68% from last quarter, and up 9.38% from last year).

Avg $$$/SQFT: $457 (down -2.57% from last quarter, and up 0.7% from last year).

Sale to List Ratio: 104.12% (103.79% last quarter & 103.28% in Q3 - 2022)

11 avg days to offer (from 13 days last quarter & 15 days in Q3 - 2022)

Mattapan: 4 condos sold - up from 2 (100%) last qtr and 0 0% from last year.

Avg Sale Price: $435.7K (up 24.32% from last quarter, and down -5.53% from last year).

Avg $$$/SQFT: $387 (up 21.64% from last quarter, and up 7.88% from last year).

Sale to List Ratio: 97.17% (93.81% last quarter & 100.38% in Q3 - 2022)

29 avg days to offer (from 105 days last quarter & 18 days in Q3 - 2022)

Medford: 76 condos sold - down from 78 (-2.6%) last qtr and up 18.75% from last year.

Avg Sale Price: $749.2K (up 9.78% from last quarter, and up 7.32% from last year).

Avg $$$/SQFT: $580 (up 12.4% from last quarter, and up 13.86% from last year).

Sale to List Ratio: 100.94% (102% last quarter & 102.32% in Q3 - 2022)

15 avg days to offer (from 16 days last quarter & 22 days in Q3 - 2022)

Melrose: 12 condos sold - down from 25 (-52%) last qtr and down -60% from last year.

Avg Sale Price: $476.4K (down -14.98% from last quarter, and down -19.5% from last year).

Avg $$$/SQFT: $431 (down -14.09% from last quarter, and down -8.19% from last year).

Sale to List Ratio: 103.66% (100.82% last quarter & 101.02% in Q3 - 2022)

20 avg days to offer (from 29 days last quarter & 24 days in Q3 - 2022)

Natick: 21 condos sold - down from 25 (-16%) last qtr and down -34.38% from last year.

Avg Sale Price: $567.1K (down -15.44% from last quarter, and down -6.87% from last year).

Avg $$$/SQFT: $455 (down -0.05% from last quarter, and up 14.76% from last year).

Sale to List Ratio: 104.12% (102.35% last quarter & 102.15% in Q3 - 2022)

7 avg days to offer (from 13 days last quarter & 12 days in Q3 - 2022)

Needham: 12 condos sold - down from 14 (-14.3%) last qtr and down -25% from last year.

Avg Sale Price: $831.1K (down -25.72% from last quarter, and down -11.56% from last year).

Avg $$$/SQFT: $461 (down -15.1% from last quarter, and up 10.34% from last year).

Sale to List Ratio: 102.84% (101.52% last quarter & 100.86% in Q3 - 2022)

13 avg days to offer (from 31 days last quarter & 14 days in Q3 - 2022)

Newton: 95 condos sold - up from 84 (13.1%) last qtr and up 2.15% from last year.

Avg Sale Price: $1.09M (down -8.21% from last quarter, and up 9.03% from last year).

Avg $$$/SQFT: $559 (up 2.17% from last quarter, and up 4.35% from last year).

Sale to List Ratio: 100.37% (100.73% last quarter & 99.95% in Q3 - 2022)

20 avg days to offer (from 24 days last quarter & 19 days in Q3 - 2022)

North End: 16 condos sold - up from 13 (23.1%) last qtr and down -38.46% from last year.

Avg Sale Price: $844.2K (up 29.8% from last quarter, and down -8.36% from last year).

Avg $$$/SQFT: $1030 (up 0.57% from last quarter, and up 1.25% from last year).

Sale to List Ratio: 96.93% (100.25% last quarter & 98.22% in Q3 - 2022)

53 avg days to offer (from 17 days last quarter & 30 days in Q3 - 2022)

Norwood: 17 condos sold - down from 18 (-5.6%) last qtr and down -10.53% from last year.

Avg Sale Price: $387.6K (down -24.74% from last quarter, and down -19.09% from last year).

Avg $$$/SQFT: $360 (up 3.1% from last quarter, and down -2.2% from last year).

Sale to List Ratio: 100.93% (102.72% last quarter & 99.58% in Q3 - 2022)

16 avg days to offer (from 15 days last quarter & 32 days in Q3 - 2022)

Quincy: 100 condos sold - up from 87 (14.9%) last qtr and up 21.95% from last year.

Avg Sale Price: $556.9K (up 3.19% from last quarter, and up 11.15% from last year).

Avg $$$/SQFT: $511 (up 7.34% from last quarter, and up 14.67% from last year).

Sale to List Ratio: 101.84% (102.06% last quarter & 101.09% in Q3 - 2022)

13 avg days to offer (from 15 days last quarter & 16 days in Q3 - 2022)

Revere: 25 condos sold - up from 15 (66.7%) last qtr and down -39.02% from last year.

Avg Sale Price: $497.7K (up 1.83% from last quarter, and up 8.5% from last year).

Avg $$$/SQFT: $427 (up 6.53% from last quarter, and up 0.55% from last year).

Sale to List Ratio: 98.49% (102.85% last quarter & 99.61% in Q3 - 2022)

18 avg days to offer (from 9 days last quarter & 22 days in Q3 - 2022)

Roslindale: 36 condos sold - down from 40 (-10%) last qtr and down -14.29% from last year.

Avg Sale Price: $561.7K (down -14.09% from last quarter, and down -10.36% from last year).

Avg $$$/SQFT: $505 (down -6.57% from last quarter, and up 6.36% from last year).

Sale to List Ratio: 103.07% (101.22% last quarter & 103.62% in Q3 - 2022)

15 avg days to offer (from 18 days last quarter & 15 days in Q3 - 2022)

Roxbury: 3 condos sold - down from 9 (-66.7%) last qtr and down -76.92% from last year.

Avg Sale Price: $384K (down -26.62% from last quarter, and down -38.13% from last year).

Avg $$$/SQFT: $538 (up 16.52% from last quarter, and up 6.85% from last year).

Sale to List Ratio: 99.44% (98.05% last quarter & 100.91% in Q3 - 2022)

35 avg days to offer (from 106 days last quarter & 19 days in Q3 - 2022)

Salem: 71 condos sold - up from 56 (26.8%) last qtr and down -16.47% from last year.

Avg Sale Price: $495K (up 4.66% from last quarter, and up 3.21% from last year).

Avg $$$/SQFT: $409 (down -0.23% from last quarter, and up 5.57% from last year).

Sale to List Ratio: 104.01% (104.27% last quarter & 102.26% in Q3 - 2022)

12 avg days to offer (from 14 days last quarter & 16 days in Q3 - 2022)

Seaport District: 12 condos sold - down from 22 (-45.5%) last qtr and 0 0% from last year.

Avg Sale Price: $3.12M (up 71.69% from last quarter, and up 102.55% from last year).

Avg $$$/SQFT: $1942 (up 23.74% from last quarter, and up 35.84% from last year).

Sale to List Ratio: 97.83% (99.3% last quarter & 99.34% in Q3 - 2022)

102 avg days to offer (from 48 days last quarter & 43 days in Q3 - 2022)

Somerville: 112 condos sold - down from 131 (-14.5%) last qtr and down -28.21% from last year.

Avg Sale Price: $942.8K (down -0.79% from last quarter, and up 10.6% from last year).

Avg $$$/SQFT: $707 (down -1.13% from last quarter, and down -2.47% from last year).

Sale to List Ratio: 99.83% (102.15% last quarter & 101.78% in Q3 - 2022)

32 avg days to offer (from 23 days last quarter & 26 days in Q3 - 2022)

South Boston: 100 condos sold - up from 98 (2%) last qtr and down -32.43% from last year.

Avg Sale Price: $856.8K (up 3.16% from last quarter, and up 2.31% from last year).

Avg $$$/SQFT: $799 (up 1.02% from last quarter, and up 0.09% from last year).

Sale to List Ratio: 99.08% (99.94% last quarter & 98.84% in Q3 - 2022)

26 avg days to offer (from 24 days last quarter & 23 days in Q3 - 2022)

South End: 136 condos sold - up from 105 (29.5%) last qtr and down -0.73% from last year.

Avg Sale Price: $1.39M (up 4% from last quarter, and up 14% from last year).

Avg $$$/SQFT: $1142 (up 7.45% from last quarter, and up 1.76% from last year).

Sale to List Ratio: 99.34% (99.35% last quarter & 99.88% in Q3 - 2022)

27 avg days to offer (from 27 days last quarter & 26 days in Q3 - 2022)

Swampscott: 10 condos sold - down from 15 (-33.3%) last qtr and down -56.52% from last year.

Avg Sale Price: $538.4K (up 19.7% from last quarter, and up 3.14% from last year).

Avg $$$/SQFT: $429 (down -10.51% from last quarter, and up 8.29% from last year).

Sale to List Ratio: 103.46% (100.44% last quarter & 100.37% in Q3 - 2022)

9 avg days to offer (from 29 days last quarter & 12 days in Q3 - 2022)

Topsfield: 5 condos sold - up from 2 (150%) last qtr and up 400% from last year.

Avg Sale Price: $600.5K (up 8.59% from last quarter, and down -29.14% from last year).

Avg $$$/SQFT: $364 (up 1.21% from last quarter, and up 40.84% from last year).

Sale to List Ratio: 101.04% (105.49% last quarter & 98.66% in Q3 - 2022)

32 avg days to offer (from 5 days last quarter & 56 days in Q3 - 2022)

Waltham: 37 condos sold - down from 39 (-5.1%) last qtr and down -42.19% from last year.

Avg Sale Price: $630K (down -2.59% from last quarter, and up 5.21% from last year).

Avg $$$/SQFT: $449 (down -2.5% from last quarter, and up 0.88% from last year).

Sale to List Ratio: 103.99% (104.12% last quarter & 101.47% in Q3 - 2022)

12 avg days to offer (from 15 days last quarter & 13 days in Q3 - 2022)

Watertown: 50 condos sold - down from 58 (-13.8%) last qtr and up 6.38% from last year.

Avg Sale Price: $780.5K (up 4.9% from last quarter, and up 11.81% from last year).

Avg $$$/SQFT: $508 (down -5.18% from last quarter, and down -2.33% from last year).

Sale to List Ratio: 102.77% (103.56% last quarter & 103.16% in Q3 - 2022)

18 avg days to offer (from 18 days last quarter & 22 days in Q3 - 2022)

West Roxbury: 28 condos sold - down from 40 (-30%) last qtr and 0 0% from last year.

Avg Sale Price: $626.1K (up 16.91% from last quarter, and up 26.88% from last year).

Avg $$$/SQFT: $555 (down -0.56% from last quarter, and up 24.65% from last year).

Sale to List Ratio: 100.09% (100.49% last quarter & 101.29% in Q3 - 2022)

26 avg days to offer (from 16 days last quarter & 16 days in Q3 - 2022)

As always, we’re here for all your real estate needs. If we can’t assist directly, we KNOW someone you can trust who can.