How is Boston Residential Real Estate Handling the New Era of Higher Interest Rates? Nonplussed.

Despite mortgage interest rates more than doubling since early 2022, home values in Greater Boston didn’t blink last year. Will 2024 hold serve?

Greater Boston’s real estate market been white hot since 2012. Homes in most parts of the metro area saw annual increases in value outpacing, in many instances, inflation. Every year, it seemed, prices went up and sales volume dropped.

The story of 2023’s and likely 2024’s market is one that pervades the Greater Boston real estate market. It’s a four syllable story.

Can you guess?

It’s not interest rates.

It’s inventory. The incredible shrinking inventory.

Looking at the last few years of residential markets around Boston, the narrative is consistent. Dwindling sales and stabilizing values.

The trends here are pretty clear. Unless/until this changes, the housing market will be challenging for interested homebuyers.

Low inventory in the local housing market is nothing new actually. Since the beginning of the last decade we’ve witnessed a gradual decline in available housing stock. This, along with a steady increase in demand, has ratcheted values upward, year in and year out.

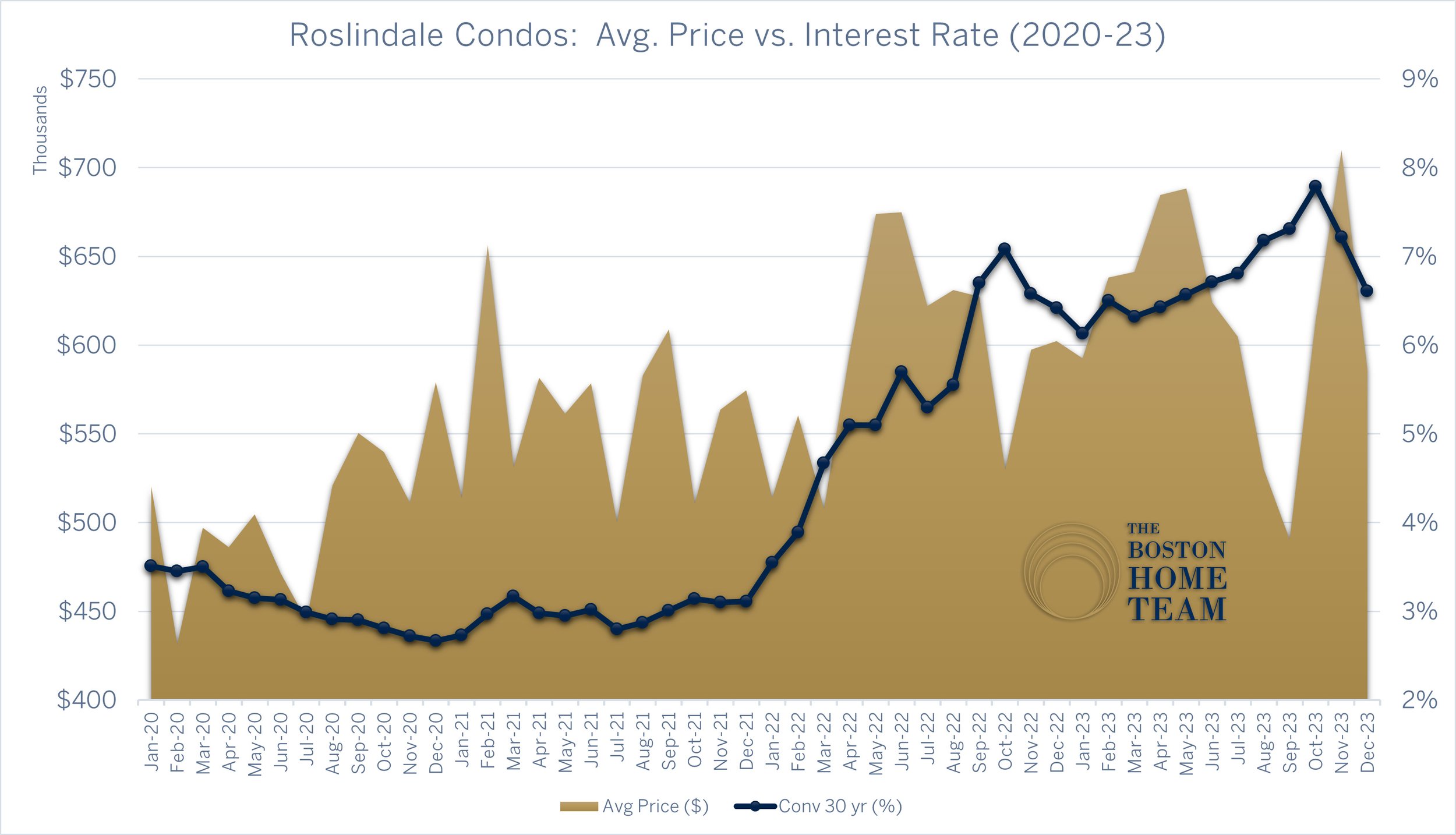

Even after an eye-popping spike in mortgage rates in early 2022, values across Greater Boston were stable between 2022 and 2023 and generally rose.

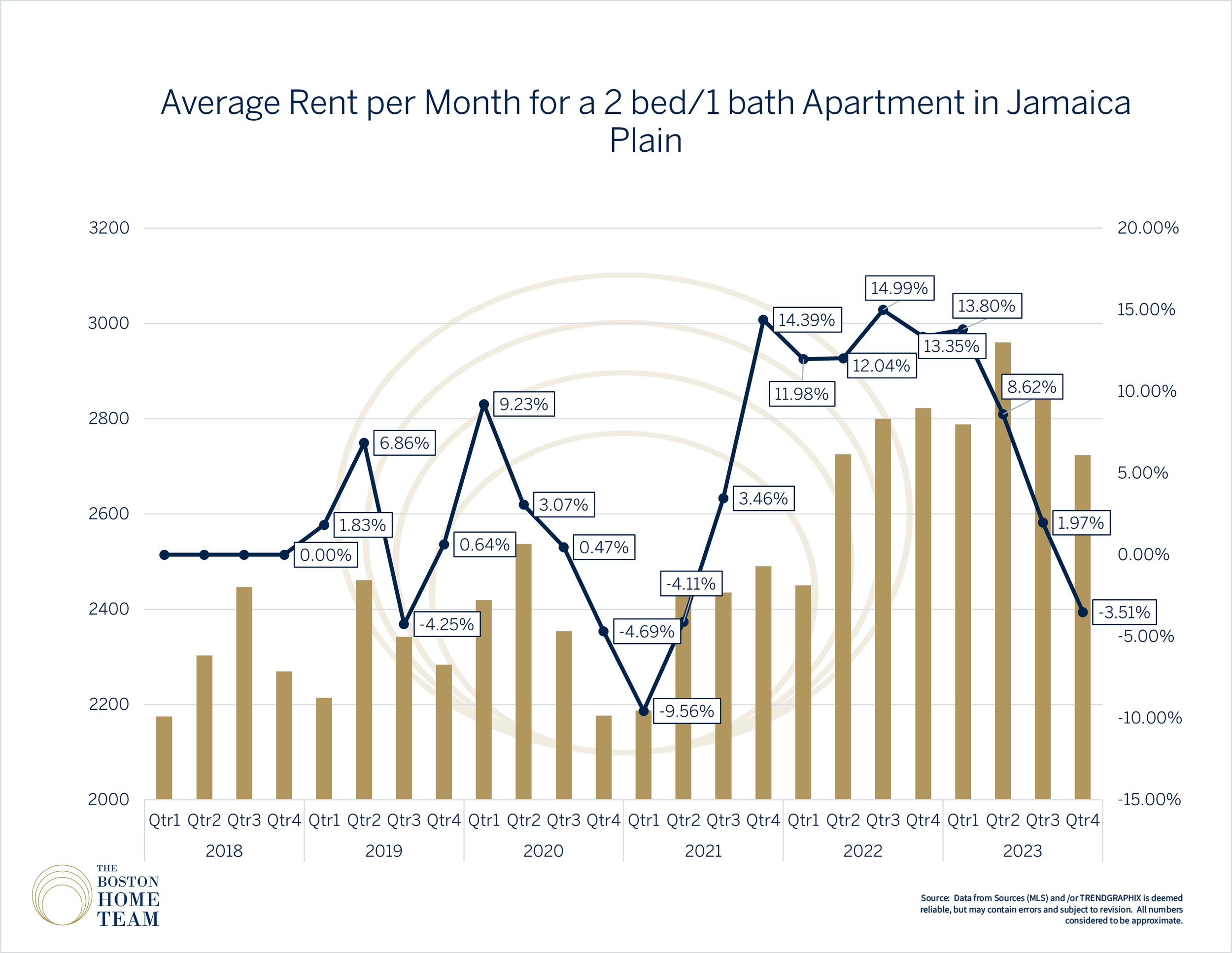

Some markets saw values rise and others saw some small dips.

Average sale prices: Pretty much across the board, cities and towns in Greater Boston, including Boston, saw only nominal gains and losses.

Boston’s neighborhoods—aside from Back Bay, Seaport, and Mid-town—had, on average, small gains or small losses. Nothing too exciting in either direction. JP dipped a little while Rozzie values inched up.

Most neighborhoods in Boston saw little change last year from the previous year.

Where was 2023 different?

Homes took longer to sell, and multiple bids were not as frequent as in previous years, as buyers exhibited a more discerning approach.

Sale prices landed much closer to their asking prices.

Sellers were more willing to work with buyer terms.

The big difference between 2022 and 2023 was timing and volume. It took longer on average and there were much fewer sales.

Usually, more time (more “days to offer) and tighter sale price/list price ratios (closer to or below100%) means that the market is softening. This should correlate to softening prices too (as they did in Jamaica Plain), but due to scarcity in available purchase inventory, the demand never softened.

This graph depicts the relationship between days to offer and sale-to-list price ratios. Sales exceed their list prices and sell fast early in the early, typically. Q4-23 looks a lot like the early spring. Did the spring market come early this year?

We noted that our buyer clients had more opportunities to conduct home inspections. We noted that our buyers had a little more leverage when negotiating terms like credits, repairs, or even timing. It wasn’t by any stretch, a “buyer’s market” but things were reflecting a full on “seller’s market” either.

It seemed that in general things moved at a more digestible pace. But we’re still pretty far from seeing signs of true market equilibrium.

Absorption rates between 20% and 40% (represented by the gold line) reflect market equilibrium between sellers and buyers. Only in October 2022 did the JP market come close to dropping below 40% since 2011.

Will anything change in 2024?

Probably not. At least not right away. The rates aren’t expected to drop (into the 5%’s) until much later in the year. As the rates go (we think) so goes inventory. There’s a hesitancy among homeowners desirous of moving somewhere new to give up their 3-4% mortgage rates. So they stay pat and the market continues to dry up.

Lenders are getting pretty creative in the face of these challenges, so if you’re one of those homeowners wishing to upsize or downsize, it’s worth periodically checking in with a reputable lender to find out if any of their loan programs could work for your circumstances.

Later this year, as lot of pundits are predicting, mortgage rates could fall into the 5%’s which should dislodge a portion of these folks holding out for rates closer to their current holdings. It means that things may really open up in Q4-2024 or Q1-2025.

What’s our advice?

Advice for homebuyers: With less competition, the folks who are buying now are finding sellers are more receptive to less-than-perfect offers. These same buyers are planning to refinance when the rates soften, hopefully later in the year or in 2025. If buying is on your agenda, get out there sooner rather than later.

Advice for home sellers: If this is the year you’re planning to move, start the process now, well in advance of the spring. All indications are that there is a pent up need to sell which, by mid year, could mean a log-jam of property listings, giving buyers a little more leverage than they’ve had. Staging, cleaning, and making repairs are still essential in getting the best price so take the time to get it right.

Advice for either: Call us, the Boston Home Team! We’ve got decades of sales and transactional experience under our belts. We know these local markets better than most and we’re well equipped to help.

What’s below: There’s a LOT of data out there! Below is a gallery of many of the charts and graphs we employ for our market studies or in CMAs for our clients. Most of these relate to 2023, with a stronger focus on JP and Roslindale.